schedule c tax form llc

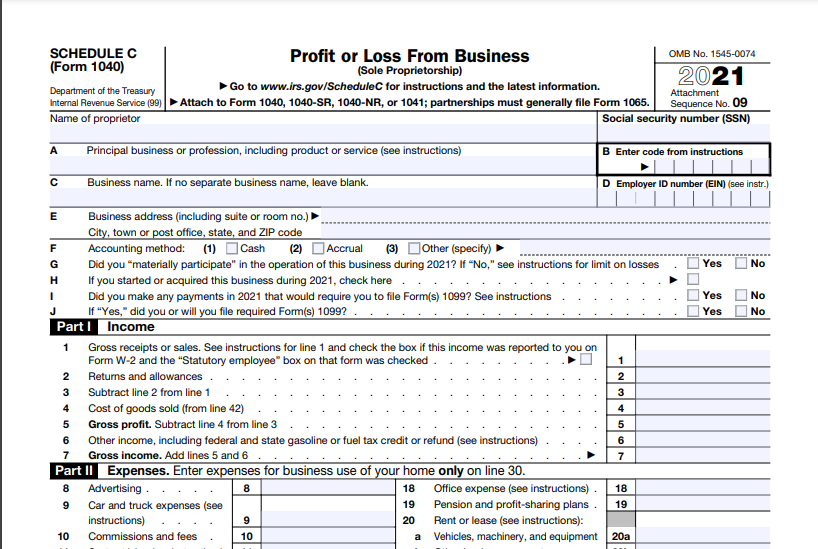

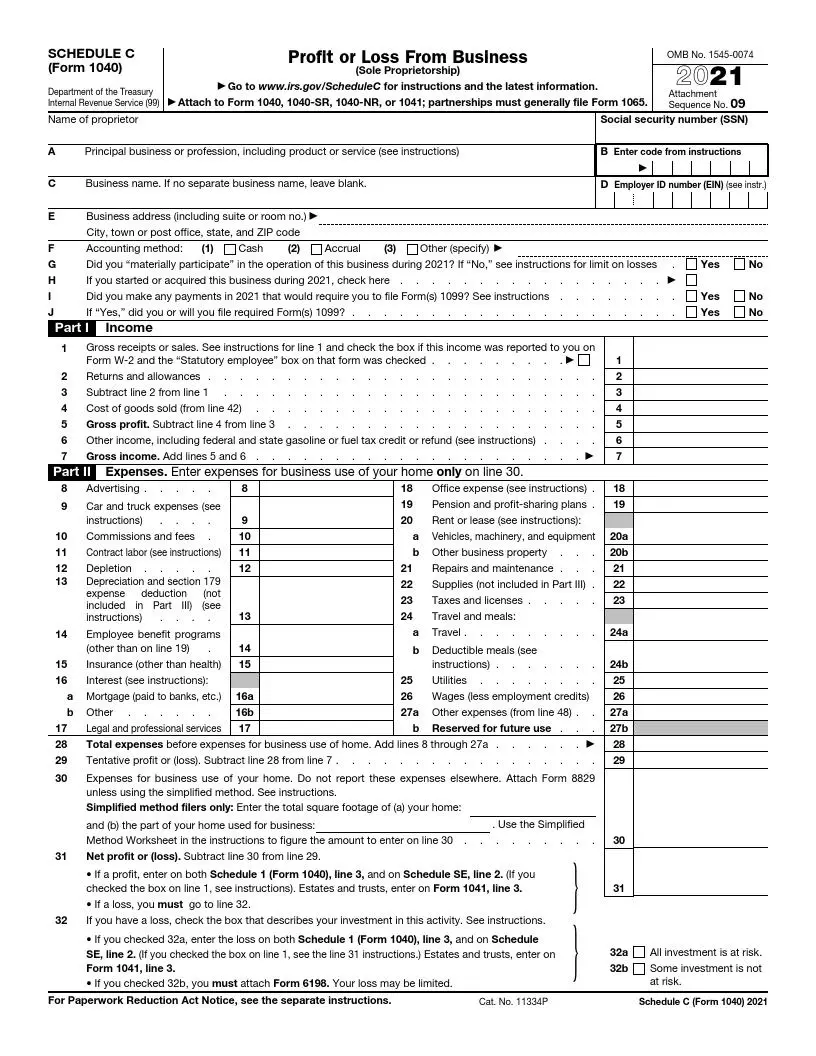

The Schedule C tax form combines a sole proprietors business income and expenses to determine the net profit reported on Form 1040. Long story short the profit or loss you make on your business flows through is reported in your personal income tax return.

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Forms Irs Taxes Irs Tax Forms

Because you put your SS on the SS-4 form when you applied for the EIN the 2 are linked automatically.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

. A Limited Liability Company LLC is an entity created by state statute. Create A Free Account And Fill Out Customized Templates For Free. I already filed my personal tax return and then realized I might need to file a schedule c form 1040.

SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and the latest information. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. You need to obtain an EIN for the LLC before you can complete the.

LLC one owner - Form K1 or Schedule C. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Click on column heading to sort the list.

Ad Access IRS Tax Forms. 1065 or Schedule C for two owners. The form is part of your personal tax returnSchedule C is typically filed with Form 1040.

If you run your own business youll generally need to complete an IRS Schedule C to. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses. Besides that most crypto mining companies dont also issue any 1099s to report all of the income they receive which even makes taxes more.

Thus putting the EIN on the Sch C along with the SS is allowed but not REQUIRED so either way is just fine according to the IRS. An LLC Schedule C should be used by a single-member LLC when filing business taxes as a sole proprietor. Learn about Schedule C for the current tax year how to prepare this form and how and where to file it.

As you will see by reading this article Schedule C can be complicated. Single-member LLCs will file IRS Form 1040 Schedule C E or F Single-member LLCs cannot file partnership return forms. Small business owners who are filing business taxes as a sole proprietorship or single-member LLC must file using Schedule C Profit or Loss from Business.

Your primary purpose for engaging in the activity is for income or profit. Forms and Publications PDF Instructions. The form is titled Profit or Loss from Business Sole Proprietorship If you are the sole proprietor of a business or have single-member LLC youll fill out this form when you do your taxes each year.

The profit is the amount of money you made after covering all of your business expenses and obligations. You and your spouse must each report your individual shares of the income generated by the partnership income. Responses to your questions.

You are involved in the activity with continuity and regularity. An activity qualifies as a business if. Multiple-member LLCs may file Form 1065 which is for partnerships.

You will file the LLCs federal income tax return using IRS Form 1065 US. Report Inappropriate Content. LLC ein on schedule c.

And Schedule C is. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. I started an LLC in the middle of 2016 for my personal photography business but I never actually started the business up I didnt have time.

Schedule C is a tax form for small business owners who are either a sole proprietor or have a single-member LLC. Ad Fillable SCHEDULE C Form 1040. Crypto mining is quite different from other sources of income because theres no employer to issue you a W-2 reporting for your total gross income.

Return of Partnership Income. Sole proprietors must also use a Schedule C when filing taxes. Attach to Form 1040 1040-SR 1040-NR or 1041.

Partnerships must generally file Form 1065. Ad Fill Out Your Form In Minutes With Our Template Builder. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity.

Its part of the individual tax return IRS form 1040. Select a category column heading in the drop down. Printable SCHEDULE C Form 1040 blank sign forms online.

You file this form. Enter a term in the Find Box. Its important to note that this form is only necessary for people who have had income reported on 1099 forms meaning they are considered contract employees rather than full employees of the company or organization contracting them.

A Schedule C form is a tax document filed by independent workers in order to report their business earnings. You will need to include a Schedule K-1 for yourself your spouse and any other partners who may have an interest in the LLC. Your single member LLC is considered a disregarded entity as far as the IRS is concerned.

This means you will complete a Sch C and a form 1065. Schedule C or LLC for Cryptocurrency Earned from Crypto Mining. You may be able to enter information on forms before saving or printing.

Limited Liability Companies LLCs are required to file one of the following forms depending on how it has chosen to be taxed. Report Inappropriate Content. Click on the product number in each row to viewdownload.

You need to split the income expenses between the two of you up until the time you formally set up the partnership in the state. Build Paperless Workflows with PDFLiner. Do I really need to file it if I received zero dollars from my LLC.

Complete Edit or Print Tax Forms Instantly. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files. Schedule C Form 1040 is a form attached to your personal tax return that you use to report the income of your business as well as business expenses which can qualify as tax deductions.

A Limited Liability Company LLC is an entity created by state statute. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes. Adding Schedule C to Your Tax Return.

Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. By contrast formally structured business entities such as corporations partnerships and some limited liability companies LLCs file separate tax returns. The IRS forms for LLC filings vary.

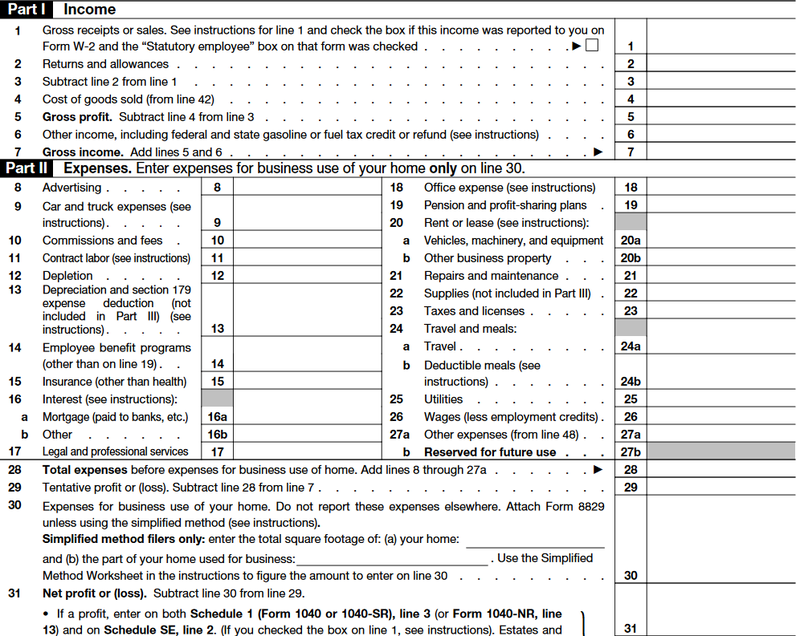

Schedule C details all of the income and expenses incurred by your business and the resulting profit or loss is included on Schedule 1 of Form 1040. If you have a profit for the yearthat is if your total income is greater than your total expenses by subtracting line 30 from line 29enter the amount on line 31. Save Print Download.

Its Quick Easy 100 Free. There are several steps to adding your Schedule C information to your Form 1040 depending on whether you have a profit or a loss. Youll report all business income and expenses on SCH C as a part of your personal tax return.

Edit Fill Sign Share Documents.

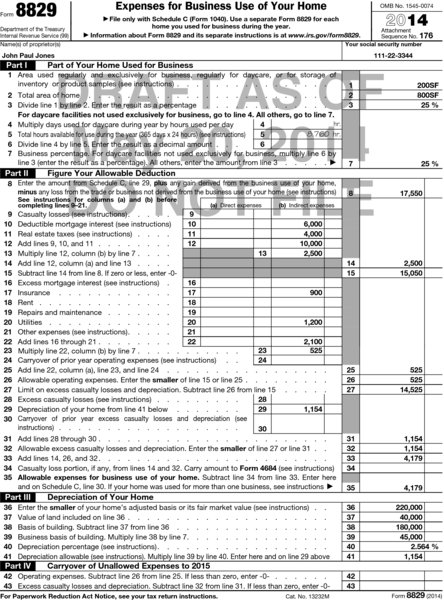

What Is Schedule C Tax Form Form 1040

Irs 1040 Schedule C 2020 2022 Fill Out Tax Template Online

How To Fill Out Your 2021 Schedule C With Example

Self Employment Income How To File Schedule C

How To Fill Out Schedule C For Business Taxes Youtube

What Is Schedule C Form 1040 Uber Lyft And Taxi Drivers Gig Workers Friendly Tax Services Accountants And Tax Preparers

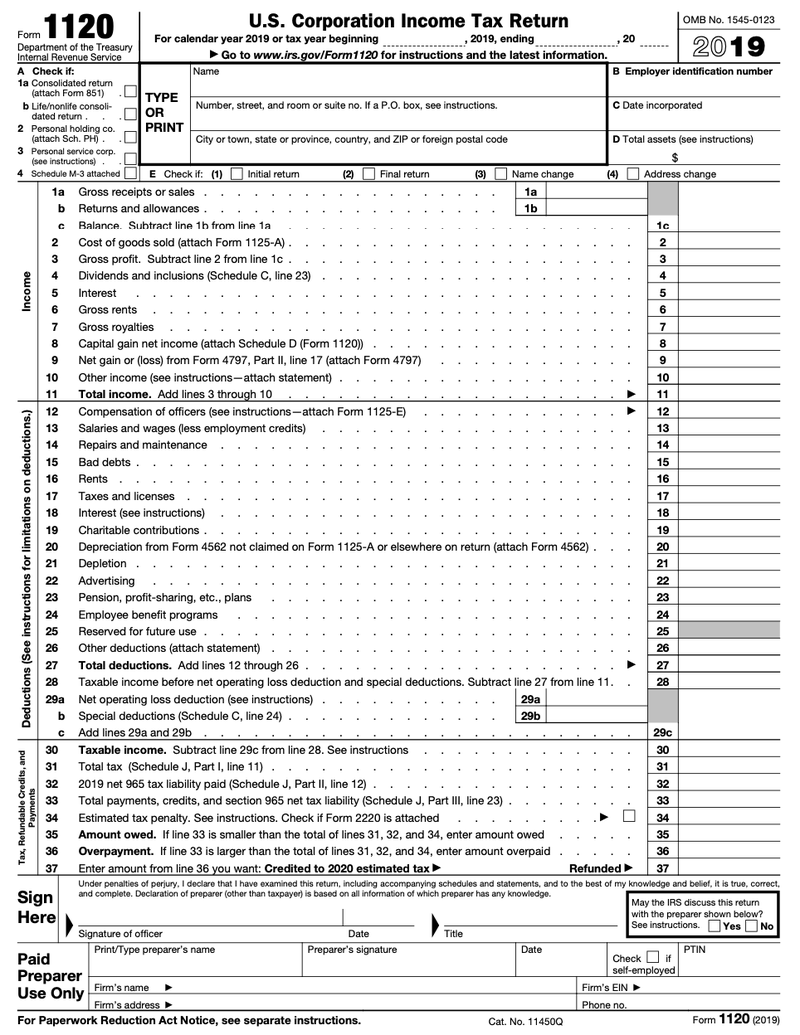

How To File Tax Form 1120 For Your Small Business

How To Fill Out Your 2021 Schedule C With Example

Filing A Schedule C For An Llc H R Block

2021 Schedule C Form And Instructions Form 1040

What Is An Irs Schedule C Form

Where Do I Deduct Website Expenses On Schedule C Taxes Arcticllama Com

Sole Proprietor Tax Forms Everything You Ll Need In 2022

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is An Irs Schedule C Form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)